How Do I Notify The Irs Of A Business Name Change

Note: If you lot haven't changed your LLC name with the state, you lot'll demand to file an Amendment.

How to modify your LLC proper name with the IRS will depend on how your LLC is taxed.

Note: There is no toll associated with changing your LLC name with the IRS.

LLC taxed every bit a C-Corporation

If your LLC is taxed like a C-Corp, you don't have to mail a special letter of the alphabet to the IRS.

Simply check off "name alter" at the top of Form 1120 when taxes are filed.

LLC taxed equally an S-Corporation

If your LLC is taxed like an S-Corp, you don't have to mail a special letter to the IRS.

But cheque off "name change" at the top of Class 1120S when taxes are filed.

Foreign-owned LLC

If yous're a not-Usa resident/denizen and you own a U.Due south. LLC, it depends on how many LLC Members at that place are.

• If your LLC has 2 or more Members, follow the instructions for "LLC taxed as Partnership".

• If your LLC has ane Member, follow the instructions for "LLC taxed as Sole Proprietorship".

Tip: If your LLC has i Member, make sure you read well-nigh the Class 5472 requirement for foreign-endemic Unmarried-Member LLCs.

LLC taxed as a Partnership

An LLC with two or more than Members is, by default, taxed like a Partnership. You lot don't have to mail a special letter to the IRS to change your LLC name.

Simply check off "name alter" at the top of Form 1065 when taxes are filed.

Note: If your LLC is owned by a married man and wife in a community belongings state (and you've elected to be taxed as a Qualified Joint Venture), please see "LLC taxed as Sole Proprietorship" below.

LLC taxed equally a Sole Proprietorship

An LLC with 1 Member is, past default, taxed similar a Sole Proprietorship.

In order to change your LLC name with the IRS, y'all'll demand to mail them a alphabetic character and show proof of the state approving your LLC proper noun modify.

Yous can download our IRS LLC proper name modify alphabetic character beneath and follow the instructions.

IRS LLC name alter form

You tin download our LLC name change letter and postal service information technology to the IRS:

IRS LLC proper name change form (PDF)

Engagement:

Enter today's engagement at the top of the course.

To:

Check off either the Kansas City, MO accost or the Ogden, UT accost.

Use Kansas City if your LLC is located in:

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Northward Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, Westward Virginia, or Wisconsin.

Use Ogden if your LLC is located in:

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, or Wyoming.

Prior Business organization/LLC Name:

Enter your prior LLC name.

Please annotation that the name of the LLC has been inverse to:

Enter your new LLC name.

Note: Remember to include a copy of your country-canonical LLC Amendment showing the new LLC name.

After you take updated your records, please ship a written confirmation to:

Enter your mailing accost here. Information technology can be any accost you lot'd like. It doesn't take to match your existing IRS or state records.

Signature & contact info:

The possessor of the LLC must exist the i signing this grade. Then enter your name, title (use "owner"), and telephone number.

Include a copy of your LLC Amendment from the Country

In order to change your LLC proper noun in most states, you lot'll file an Amendment (oft called Certificate of Amendment or Articles of Amendment) with the Secretary of State or like agency.

Make sure to include a stamped/approved copy of your LLC's proper noun change Amendment course with the letter that you mail to the IRS.

IRS mailing addresses

Check the list in a higher place to see which address to use. You'll be mailing your "IRS LLC Name Change Letter" and your stamped/approved LLC Amendment name change form to either:

Entity Department

Internal Revenue Service

Kansas Urban center, MO 64999

OR

Entity Section

Internal Revenue Service

Ogden, UT 84201

Note: There is no street accost needed. The IRS is so big that they take their own zero code!

Blessing for IRS LLC name change

On average, it takes about xxx days to receive an LLC name change confirmation letter from the IRS, but delight allow 45 to 60 days.

If you don't get annihilation dorsum by then, don't ship another letter to the IRS (that can cause more confusion); instead, call them at the phone number below. Provide your LLC proper name and EIN Number and inquire them to check their records and allow you know the status. Often you can simply enquire them over the phone to mail service some other confirmation letter. They may likewise be able to fax you a copy as well.

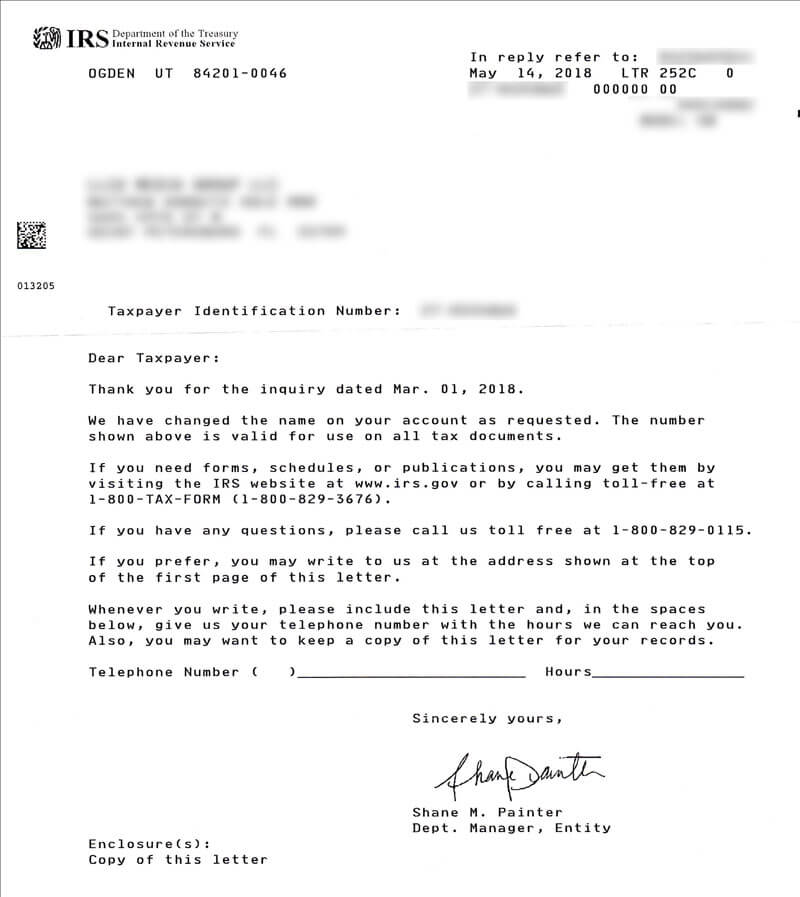

Your approval will be a ii-page letter. Here is what folio 1 volition look like:

IRS contact info

You can contact the IRS at 800-829-4933. Their hours are Monday through Fri from 7am to 7pm, local fourth dimension (based off of surface area code you lot're calling from).

Where else should you update your LLC proper noun?

You should also update your LLC proper name with the places listed below.

Yep, information technology'south a lot. Create a spreadsheet and take it boring. You can do your name changes gradually every bit your old LLC name will still "work" for a while.

- business bank account

- business organization debit carte du jour

- business checks

- paypal or other online banking solutions

- commercial registered agent (if applicable)

- concern credit cards

- state Department of Revenue (or equivalent agency)

- local tax office (urban center, county, township)

- business organization licenses and permits

- website, domain registrar, hosting visitor

- utility companies

- letterhead, logos, invoices, contracts, and of import documents

- auditor

- attorney

- online business relationship registrations

- anywhere else y'all do business organisation

Note: Form 8822-B is not for an LLC name change

Form 8822-B ("Change of Address or Responsible Party — Business organization") cannot exist used to update an LLC name with the IRS.

Course 8822-B is used to change an LLC address with the IRS and/or to change the LLC EIN responsible party.

Source: https://www.llcuniversity.com/irs/llc-name-change/

Posted by: cooksidid1965.blogspot.com

0 Response to "How Do I Notify The Irs Of A Business Name Change"

Post a Comment